The Big Bang of Stablecoins

Many expect a power law for stablecoin winners. Its more complicated than that. We're in a multi decade era of financial unbundling and a 'big bang' of stablecoins.

Thousands of stablecoins will emerge, potentially leading to the first $1T stablecoin and several worth $10-$100B, in this decade.

Today's duopoly are 1st gen stablecoin architecture, akin to the first New York Times website being merely a PDF in 1996.

This post originally appeared on 𝕏, presented live at ETH Belgrade 2024 (video).

2/n

Bad news first

3/n

Today’s US Dollar does not resemble its original asset backed self. Its based on the fiat standard leveraging artificial network effects, with inflation out of control.

The US Dollar buys 2-3 times less than it did 4 years ago, and 9 times less than it did in the 1970s.

4/n

We are in an inflation pandemic.

These lines represent inflation across 30 countries since 1960.

Currently, there are 5 countries worldwide with an inflation rate higher than 100%, and 23 countries exceeding 20%. The cost of sending a $200 international remittance can be as high as $8 to $34 depending on the send/receive corridor.

Getting credit may depend on the gray markets and sometimes results in unfair loans, data theft, harassment and physical harm.

The need for safe, stable money has never been more important.

5/n

Good news

6/n

Technological revolutions begin with new innovations, finding their way into speculation that exceeds reality, and the successful ones go onto wider adoption.

We are in the 5th technological revolution of digital information, communications (and value) and witnessing revolutions inside of other revolutions.

Inspiration: Carlota Perez

7/n

Just a reminder on how the S curve works.

Inspiration: Everett Rogers

8/n

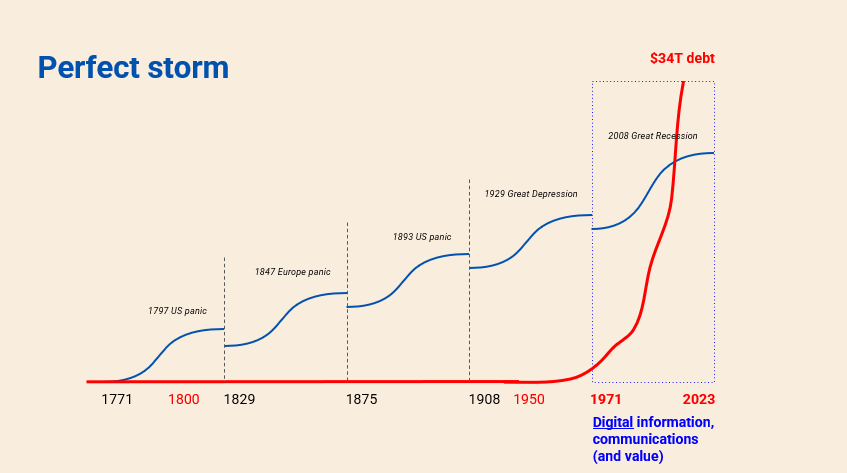

The US Debt explosion during the 5th technological revolution is a perfect storm

9/n

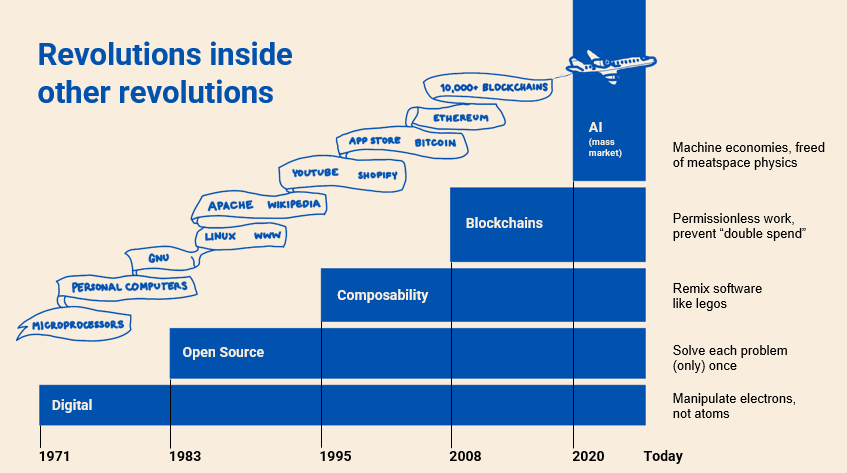

Within the 5th technological revolution of digital information, communications (and value) there are smaller revolutions compounding on each other:

1. Digital (1970s) manipulate electrons rather than atoms

2. Open source (1980s) create solutions once, use everywhere

3.Composability (1990s) remix software like legos

4.Blockchains (2000s) permissionless work, prevent "double spend"

5. AI (2020s) machine economies, unfettered by meatspace physics

10/n

The net result is the democratization of tools of production & distribution and hyperconnectsupply and demand, for all kinds of use-cases (including stablecoins).

11/n

This phenomena was observed in 2006 – The Long Tail – why the future of business is selling less of more.

12/n

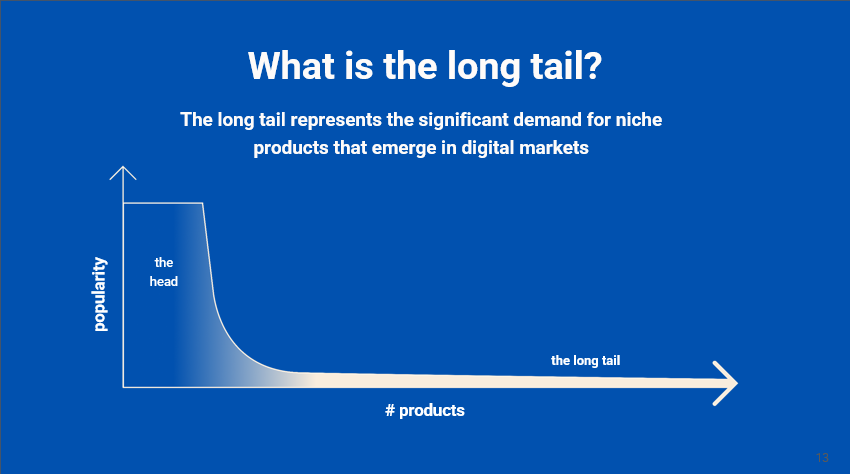

So. What is the long tail?

The long tail represents the significant demand for niche products that emerge in the digital age of online markets.

The Y axis is popularity, the X axis is the number of products. Before the digital revolution of the 90s, most industries were relegated to only making hits in order to survive. Everything was driven by the gatekeepers.

13/n

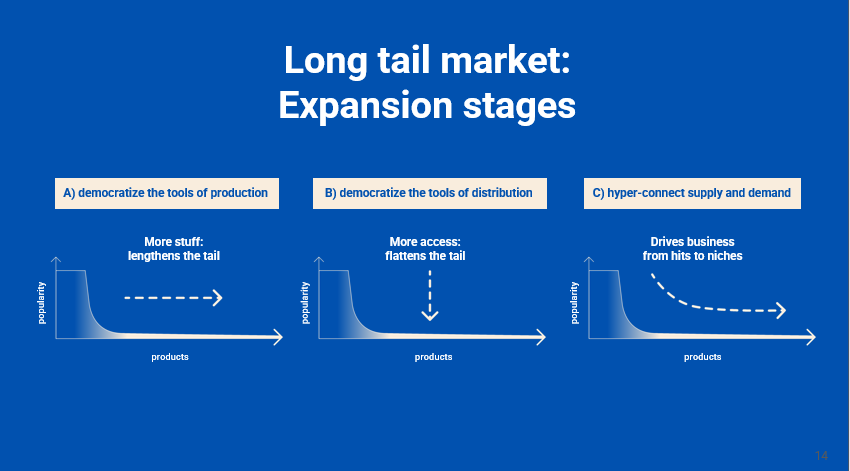

Long tail markets have different expansion stages.

First, they democratize tools of production = so more stuff lengthens the tail.

Second, they democratize the tools of distribution = more access flattens the tail

Last, they connect supply and demand, = which drives business from hits to niche

Open source and composability is a force multiplier for the long tail.

14/n

What can other industries teach us? Shopping? Broadcasting? Mobile apps?

15/n

In the 1980s we mostly congregated in malls with a limited number of stores and products that were approved by the gatekeepers.

This is the tyranny of physical space. Today there are over one million merchants on the Shopify platform alone.

16/n

In the 1980s launching a broadcast channel cost in excess of $10s of million of dollars and took years to launch.

Today, anyone can do it, for free, in a few minutes.

17/n

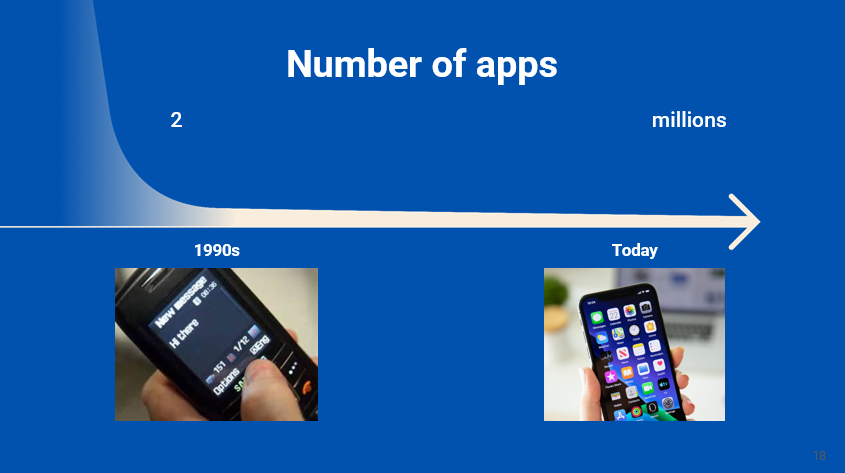

The og phone app was talking on the phone. Then we got SMS texting. Now there are over 2 million apps in the app store.

18/n

Free tools, creativity, infinite distribution and incentives. Does that sound familiar? Its happening right now in the Ethereum ecosystem.

Remember those long tail market expansion stages: (a) Democratize the tools of production, (b) democratize the tools of distribution, then (c) connect supply and demand.

Unique this time is decentralization and composability, a powerful force for expansion to occur faster than we’ve ever seen in history.

19/n

👀

20/n

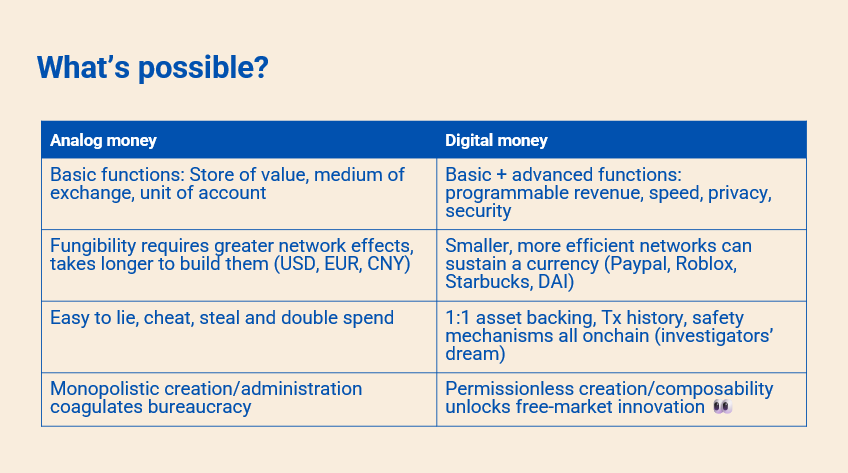

Analog money is stuck in the past: basic functions, slow to scale (USD, EUR), easy to fraud, and bureaucratic.

Digital money is the future: programmable, fast, secure, efficient network effects (PayPal, DAI), transparent transactions, and fosters free-market innovation.

21/n

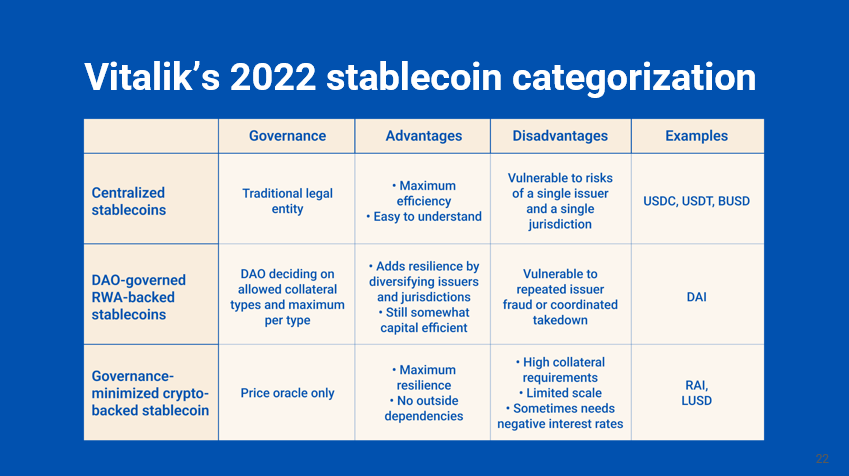

This is Vitaliks stablecoin categorization from a Dec 2022 post on whats exciting him in the Ethereum ecosystem.

He dives into three categories: (a) centralized, (b) DAO governed real world asset backed and (c) governance minimized crypto backed

Centralized stablecoins make up something like greater than 95% market share, but dare I be cliche and say, were early.

22/n

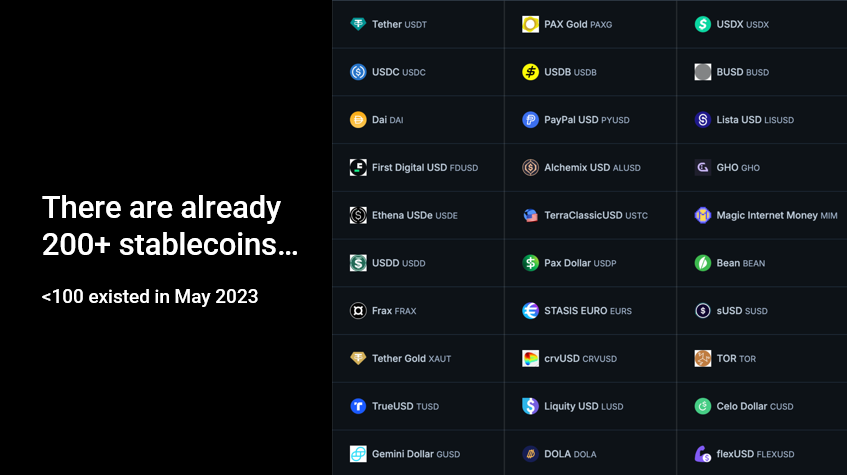

There are already 200+ stablecoins. Less than 100 existing this time last year.

23/n

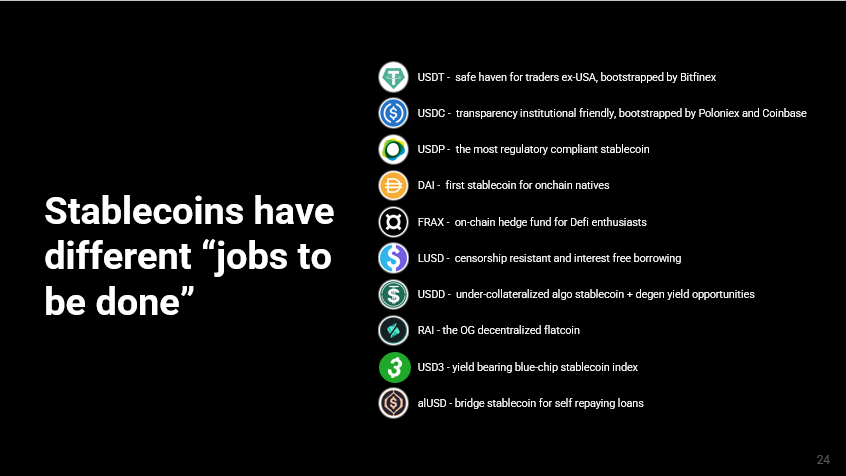

Here are some popular stablecoins, each have different jobs to be done

Tether was the first, provided a safe haven for traders and bootstrapped by Bitfinex.

DAI was the first stablecoin for onchain natives.

USD3 is a yield bearing blue chip stablecoin index.

alUSD is pretty cool as a bridge stablecoin for people accessing self repaying loans.

24/n

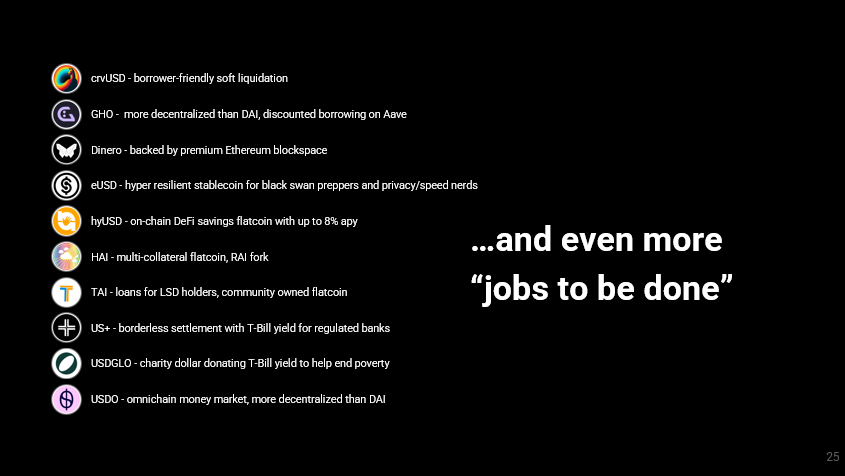

The list goes on. With even more jobs to be done.

crvUSD offers a more user friendly soft liquidation engine for borrowers

hyUSD is an on-chain DeFi savings account

USDGLO is a charity dollar donating T-Bill yield to help end poverty

Programmability changes everything. More new stablecoins could launch in 2024, than in the last decade combined.

25/n

So...stability over centuries?

26/n

Time to experiment

27/n

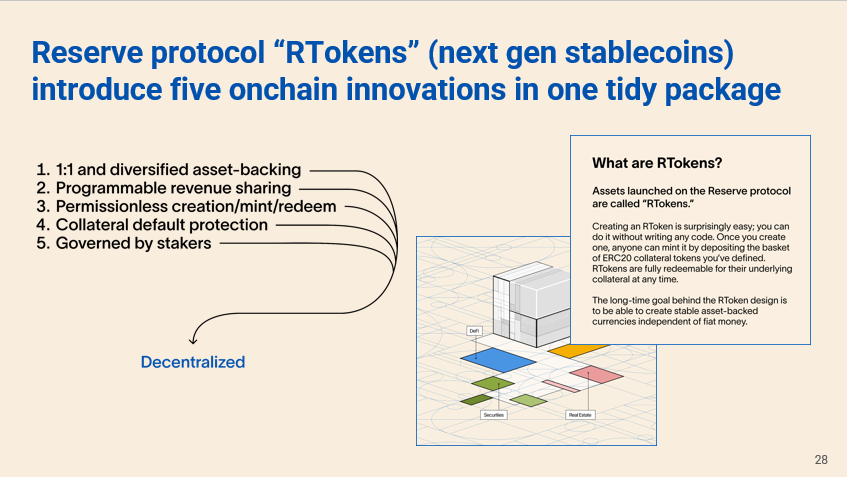

Reserve protocol “RTokens” (next gen stablecoins) introduce five onchain innovations in one tidy, decentralized package.

28/n

The Reserve ecosystem is whats UP

29/n

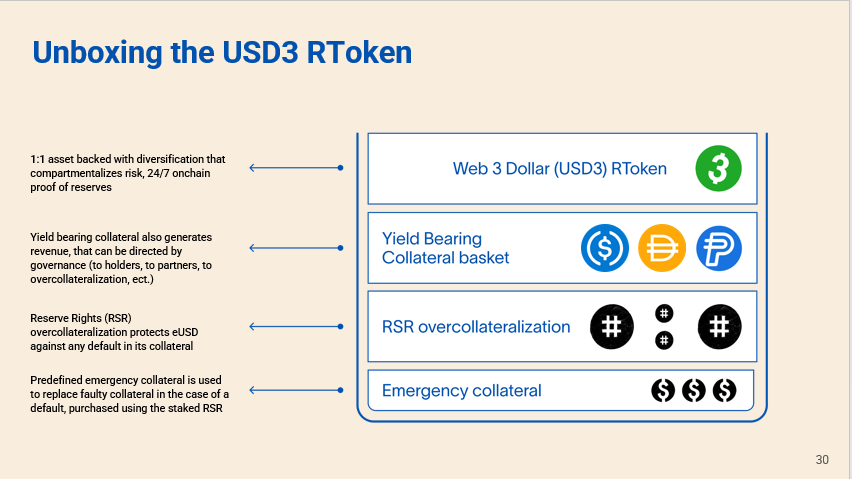

The Web 3 Dollar (USD3) Rtoken allows users to earn the DeFi rate anytime they are in stables.

@USD_3 features blue chip asset-backing with overcollateralization to guard against black swans and bank runs.

30/n

Visit and create your own RToken today

Free to use, no fees. app.reserve.org/deploy

31/n

Choose from over 60 collateral plugins to diversify your asset backed RToken

32/n

Who might deploy or utilize new stablecoins in the future?

Short answer: maybe more than we think. Each of these groups has a different motivation, a different job to be done.

33/n

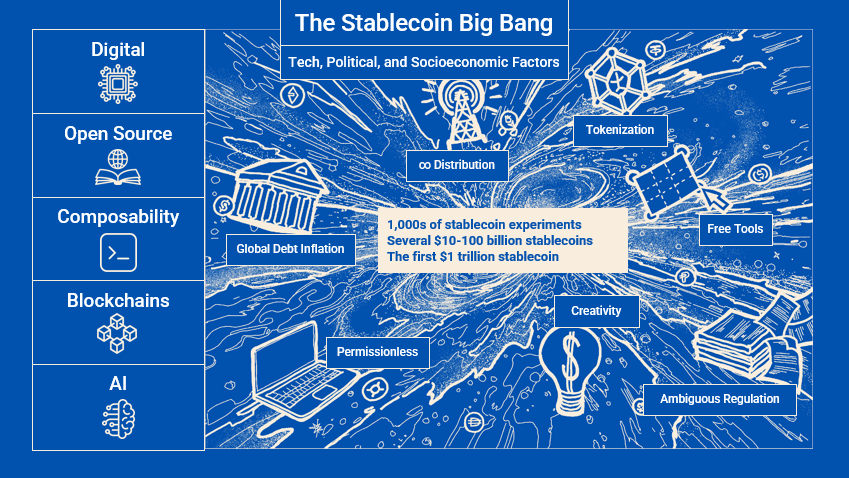

This perfect storm is leading to a stablecoin big bang:

Enablers include:

-Digital - manipulate electrons instead of atoms

-Open source - Solve each problem (only) once

-Composability - Remix software like legos

-Blockchains - Permissionless work, prevent “double spend”

-AI - Machine economies, freed of meatspace physics

Other factors include free tools, creativity, infinite distribution, and incentives accelerating pockets of innovation. The big bang could be 1,000s of stablecoin experiments with a subset snagging 5% ($4.1 trillion) of $82.6 trillion “broad money M2” supply in this decade.

34/n

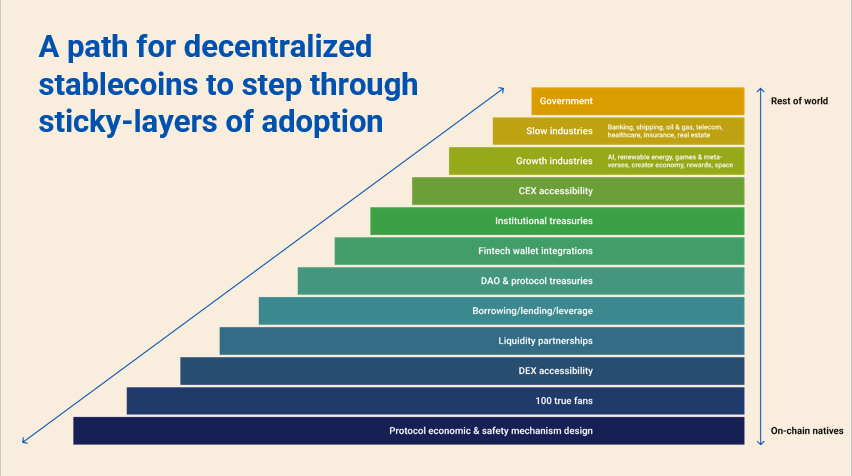

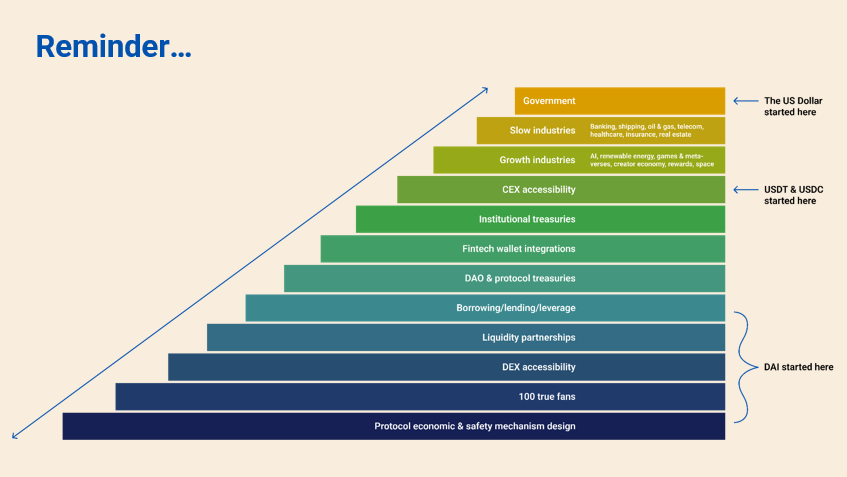

The path for decentralized stablecoins to step through sticky-layers of adoption, reminds me of a staircase. Many steps to climb.

35/n

Different strokes for different folks.

The US dollar started in government. Tether & Circle started as a bolt-on to centralized exchanges. DAI started onchain helping natives expand capital.

36/n

Hit this QR code to join the Reserve ecosystem to help you design, launch and govern your own stablecoins. Its free.

37/final

Thanks for reading. Presenting this today at @ethbelgrade.

Appreciate shares or critique.

This post originally appeared on 𝕏, presented live at ETH Belgrade 2024 (video).

• • •